DrugTimes:InnoCare Pharma: A Sample of Accelerated Commercialization for Biotech Companies

Over the past few years, influenced by various factors, the biopharmaceutical industry has faced significant challenges. Now, as domestic policies supporting the entire industrial chain of innovative drugs begin to take effect, and the Federal Reserve’s interest rate cut in September seems almost certain, innovative drug companies that have weathered many storms are eagerly looking forward to better days ahead. The future is undoubtedly bright, but before the dust settles, the innovative drug industry still relies on a few “top students” to support the precious confidence of the industry.

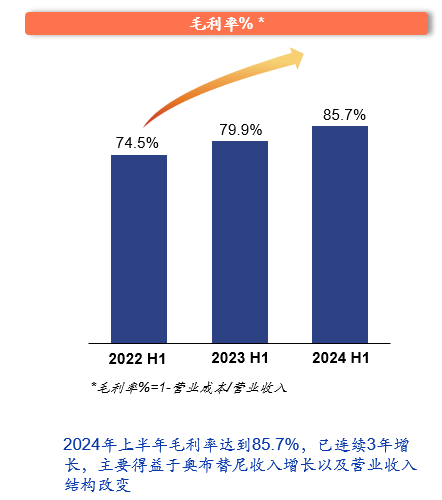

InnoCare Pharma is precisely the “child next door” that excels. The mid-year report for 2024 shows that InnoCare Pharma’s core commercial product, Orelabrutinib, achieved a revenue of 420 million yuan in the first half of the year, a year-on-year increase of 30%, with the gross margin further optimized to 85.7%, an increase of 5.8 percentage points. In the second quarter, the performance of Orelabrutinib was even stronger, with sales revenue in the exclusive indication of MZL (marginal zone lymphoma) growing by 49% year-on-year, and the overall loss for the first half of the year was significantly reduced by 38%.

More importantly, considering the smooth progress of the core product’s commercialization, InnoCare Pharma has raised its performance guidance for the sales revenue of Orelabrutinib in 2024 from at least a year-on-year increase of 30% to 35%.

Outstanding performance during “hard times” can often boost confidence. With the fulfillment of commercial expectations and the raising of performance guidance, and with the contribution of the exclusive indication for MZL being listed and included in the National Reimbursement Drug List (NRDL), InnoCare Pharma’s commercialization capabilities have stepped onto a new level.

Table of Contents

- Exclusive indication MZL boosts the fast development of Orelabrutinib

- A Key Step in the Success of Commercialization

- Differentiated Pipeline

- Conclusion

Exclusive indication MZL boosts the fast development of Orelabrutinib

Clearly, InnoCare Pharma is full of confidence in Orelabrutinib.

With excellent efficacy and high selectivity, the BTK inhibitor Orelabrutinib has become a preferred new drug in the field of hematologic malignancy treatment. Since its launch, Orelabrutinib has been approved for the treatment of chronic lymphocytic leukemia (CLL)/small lymphocytic lymphoma (SLL), mantle cell lymphoma (MCL), and marginal zone lymphoma (MZL) in patients who have received at least one prior treatment, and all have been included in the NRDL. Especially the approval of the MZL indication makes Orelabrutinib the first and only BTK inhibitor approved for the MZL indication in China, and it is listed as a first-line recommended treatment for marginal zone lymphoma (MZL) in the “Chinese Society of Clinical Oncology (CSCO) Lymphoma Diagnosis and Treatment Guidelines 2024.”

MZL is the second most common type of lymphoma in China and has long been facing a shortage of treatment options. Experts have said that Orelabrutinib has good safety, and this class of drugs is mainly oral, which is quite convenient, thus providing a convenient choice for patients’ long-term medication or home medication. Previously, MZL patients could only be treated with chemotherapy, but now, with the advent of small molecule targeted drugs represented by Orelabrutinib, there is hope to enter an era without chemotherapy in the future.

Looking at the performance of Orelabrutinib in the second quarter, the market space for this exclusive indication of MZL is rapidly being released. InnoCare Pharma will also actively promote the first-line hematologic malignancy indications and carry out clinical research on the treatment of primary immune thrombocytopenia (ITP), systemic lupus erythematosus (SLE), and other autoimmune diseases with Orelabrutinib. From hematologic malignancies to autoimmune diseases, it highlights the huge commercial potential of Orelabrutinib.

As a core commercial product, InnoCare Pharma’s deep layout in Orelabrutinib has now reaped rewards, and with in-depth expansion in the two major fields of hematologic malignancies and autoimmune diseases, the growth rate of Orelabrutinib will also be further accelerated.

A Key Step in the Success of Commercialization

Innovation is the foundation of a Biotech company, while commercialization is a necessity for survival and development.

Exclusive market entry and accelerated clinical progress have already proven the strong R&D capabilities of InnoCare Pharma. At this point, commercialization is the key challenge facing InnoCare Pharma.

This year, InnoCare Pharma has upgraded its commercial team. At the beginning of 2024, Chen Shaofeng, a veteran with nearly 30 years of experience in the pharmaceutical industry’s market sales management and familiar with various special drug treatment fields including oncology and autoimmune diseases, joined InnoCare Pharma.

At the same time, InnoCare Pharma further promoted the optimization of operational efficiency and continued to strengthen the construction of the commercial team’s capabilities.

The commercial team continuously improves execution and operational efficiency, focuses on strategic priorities, and ensures effective implementation of the company’s market plans, thereby quickly penetrating the market and highlighting the company’s commitment to continuously create value in the field of commercialization and promote sustainable growth.

Outstanding performance is the market’s reward for the brave. Behind the growth in performance, it is not difficult to see the underlying reasons for the significant reduction in InnoCare Pharma’s losses and the significant optimization of gross margin. Looking at the first half of 2024, while InnoCare Pharma continues to expand R&D investment, its losses have been significantly reduced, and the gross margin has continued to rise, which is undoubtedly the result of improved commercialization efficiency.

(Data source: Regular reports, public data compilation)

The success in commercialization means that InnoCare Pharma has already possessed a considerable self-sustaining ability. In the long run, this also means having a stable cash flow, which can be further invested in the path of BIC/FIC that InnoCare Pharma has always adhered to, and solving unmet clinical needs.

Building a full industry chain platform from preclinical to commercialization makes the company’s operation more efficient. InnoCare Pharma’s CD19 monoclonal antibody tafasitamab, in combination with lenalidomide for the treatment of relapsed/refractory diffuse large B-cell lymphoma (DLBCL), has been accepted by the drug administration for “Biologics License Application” (BLA) and included in the priority review. It is expected that tafasitamab will be officially approved for marketing in the first half of 2025, becoming another blockbuster product for the commercial team to develop the market.

At the same time, the company is accelerating the development of the “BCL-2” inhibitor ICP-248, which has significant potential when used in combination with Orelabrutinib. The “BCL-2” inhibitor is the preferred treatment plan after resistance to BTK inhibitors, forming the best sequential treatment.

Under the rotation of the flywheel, InnoCare Pharma’s commercialization pace has entered a new stage.

Differentiated Pipeline

Centered around core products with the potential of BIC/FIC, extending to the fields of hematologic malignancies, solid tumors, and autoimmune diseases, the pipeline matrix created by InnoCare Pharma has a distinct “differentiated” characteristic.

The current winter of innovative drugs is a test of the core innovative capabilities of Biotech companies; true innovation and differentiation are the best way out.

In fact, as regulatory control over the unbridled growth of innovative drugs continues to strengthen, the advantages of differentiated layout become more pronounced. Looking at InnoCare Pharma’s autoimmune pipeline, the TYK2 inhibitor ICP-332 is one of the core pipelines of InnoCare Pharma’s layout in autoimmune diseases, widely anticipated for its best-in-class clinical data.

Currently, there is no TYK2 inhibitor approved worldwide for the treatment of atopic dermatitis (AD), but ICP-332 has recently been approved by the U.S. FDA to conduct clinical trials and has completed the first patient dosing. According to InnoCare Pharma, the drug is expected to initiate phase 3 clinical trials for AD indication in China in the second half of 2024 and will submit an IND application for the second indication, vitiligo, in phase II/III, with clinical trials already underway in the United States.

Similarly, InnoCare Pharma’s TYK2 allosteric inhibitor ICP-488 for the treatment of psoriasis has completed patient enrollment in phase II clinical trials, with data readout anticipated this year. In the field of solid tumors, InnoCare Pharma’s self-developed second-generation TRK inhibitor Zurletrectinib (ICP-723) was published in the authoritative journal, Nature’s subsidiary British Journal of Cancer, indicating that Zurletrectinib has strong intracranial activity, can treat tumors positive for NTRK gene fusions, and overcome acquired resistance to first-generation TRK inhibitors. Zurletrectinib has entered the pre-NDA preparation stage.

From the pipeline layout, it is not difficult to see InnoCare Pharma’s determination to follow a “differentiated” path.

Conclusion

What is the essence of innovative drugs, the “medicine” or the “new”? This question is akin to asking whether a company wants to survive or develop.

For Biotech to succeed, the key lies in how to balance R&D and commercialization while adhering to clinical needs as the foundation. This requires the management, R&D team, and commercialization team to have a high level of professionalism, to achieve rapid transformation of R&D results under the right strategic support, and ultimately to present good performance to the market.